In order to provide a method through which the performance of specific portfolios can be evaluated as well as the performance of the portfolio manager, two globally known formulas are used under the headings (a) Money Weighted Rate of Return (MWRR) and (b) Time Weighted Rate of Return (TWRR) . The return rate of weighted money is calculated for each dedicated portfolio and is designed in such a way to express the performance of each dedicated portfolio under the management of the portfolio manager. The time-weighted rate of return expresses the total return of all assets under the management of the portfolio manager and shows how much the portfolio manager has managed to achieve returns for investors on average in the management of the dedicated portfolios under his management. In other words, investors can evaluate the portfolio manager's performance and decide on entrusting their asset management to the portfolio manager. The portfolio manager reports the performance of the specific portfolio to the relevant portfolio owner, while he is obliged to publish the performance of the portfolio manager on his website for public information.

How to calculate the efficiency of the dedicated portfolio and the efficiency of the portfolio manager

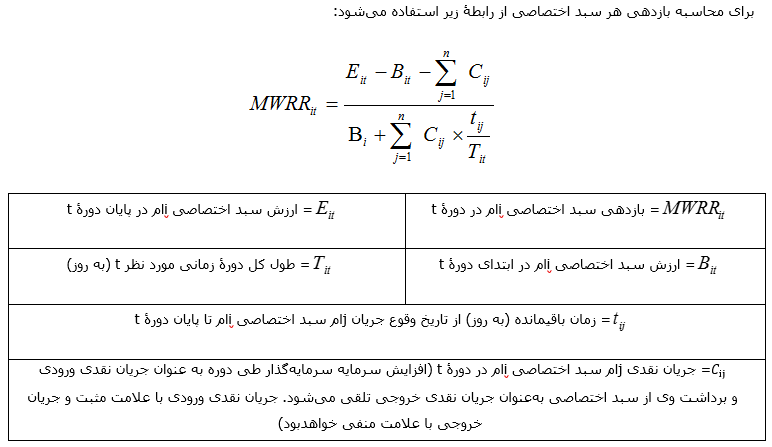

The method of calculating the yield of a dedicated portfolio

The method of calculating the yield of a dedicated portfolio

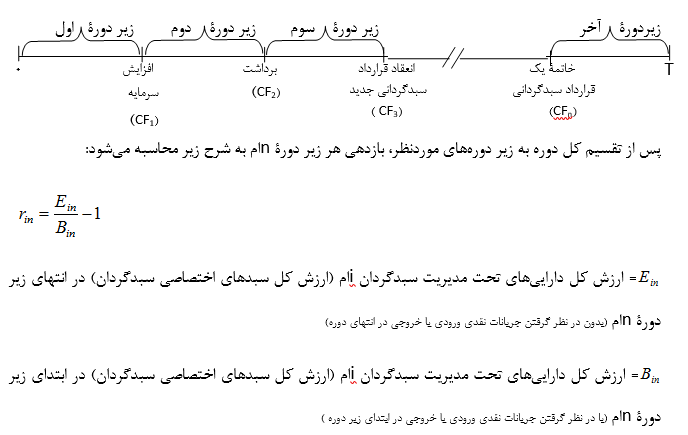

The termination date of a portfolio management contract is divided into several sub-periods. Therefore, if the incoming and outgoing flows occur on n different dates during the desired period, as a result, the entire period is divided into 1 + n sub-periods, in which the first sub-period starts from the beginning of the desired period and ends with the date of the first flow. cash flow continues, and the second sub-period starts from the date of the first cash flow and continues until the date of the second cash flow, and in the same way, the cash flow of the last period starts from the date of the last cash flow and continues until the end of the period.

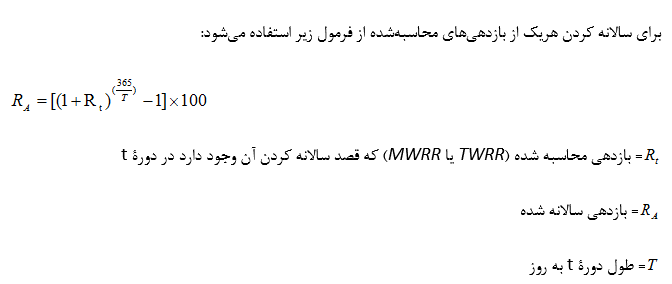

Annualizing rates of return

How to calculate the value of special portfolio assets

In calculating the rate of return of the specific portfolio and the rate of return of the portfolio manager as described in this appendix, it is necessary to calculate the value of the portfolio or specific portfolios at the beginning and end of each desired period. The value of the basket or special baskets should be calculated according to the instructions on how to determine the price of buying and selling securities in investment funds, and the following points should be considered in the implementation of this instruction:

- The value of the securities of the dedicated portfolio should be calculated based on the sale price of securities subject to the instruction 'How to determine the purchase and sale price of securities of investment funds'.

- The portfolio manager should not adjust the price of the securities of the specific portfolio based on what is foreseen in the aforementioned instructions.

- If part of the customer's return is a security document whose trading symbol is closed at the time of signing the contract, the value of that security document is considered zero in the calculations of this appendix; Whenever the trading symbol of the said security sheet is reopened, its value is calculated based on the closing price of the symbol reopening day and is considered as the new income of the investor on the same day of reopening.